Upskill your team. Accelerate AI adoption.

Transform AI into your competitive advantage.

Trusted by teams at

The upskilling platform for AI and tech adoption

Get an expert assessment of your business goals and employee skillsets.

Last year we trained more data and AI apprentices than anyone else

1,500+

companies across the UK & US trust Multiverse

22,000+

learners across our AI, data and tech programmes

£2 billion

tracked return-on-investment for our customers to date

One platform for you and your team.

Business impact you can measure

Track quantifiable return on learning investment through business efficiencies, productivity and cost-savings.

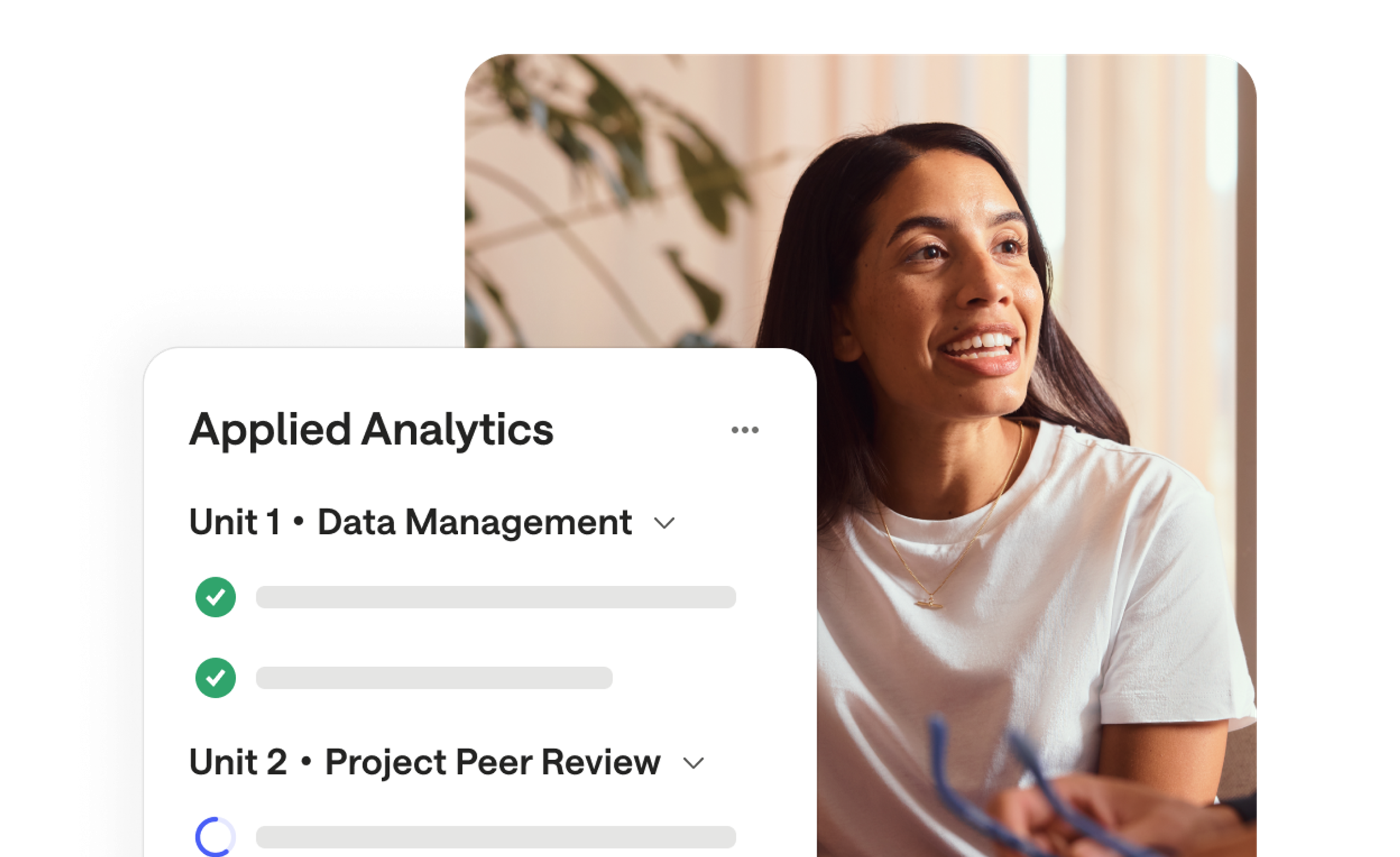

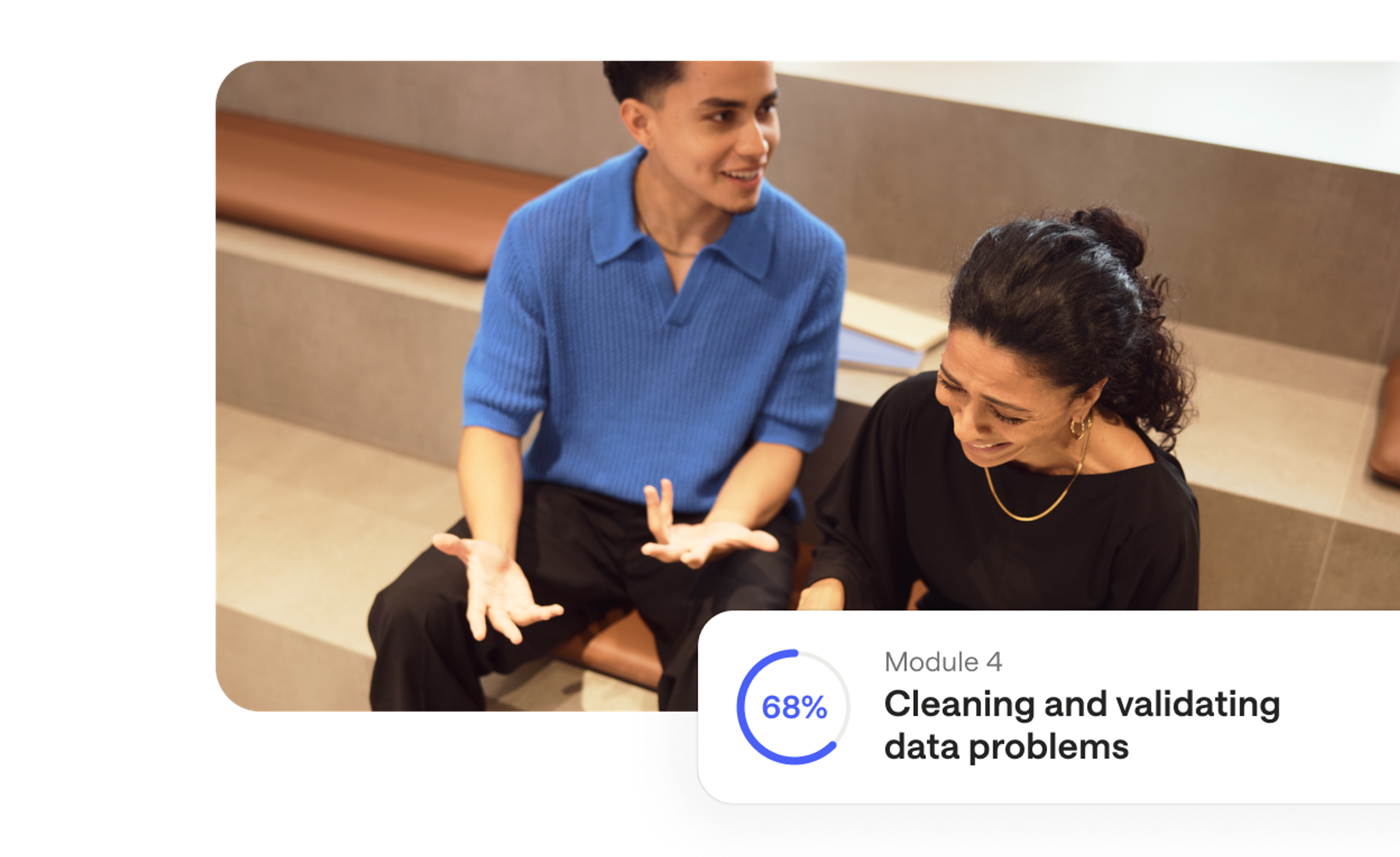

On-the-job learning

Apprentices learn in a real-world business setting, tailored to each individual and organisation.

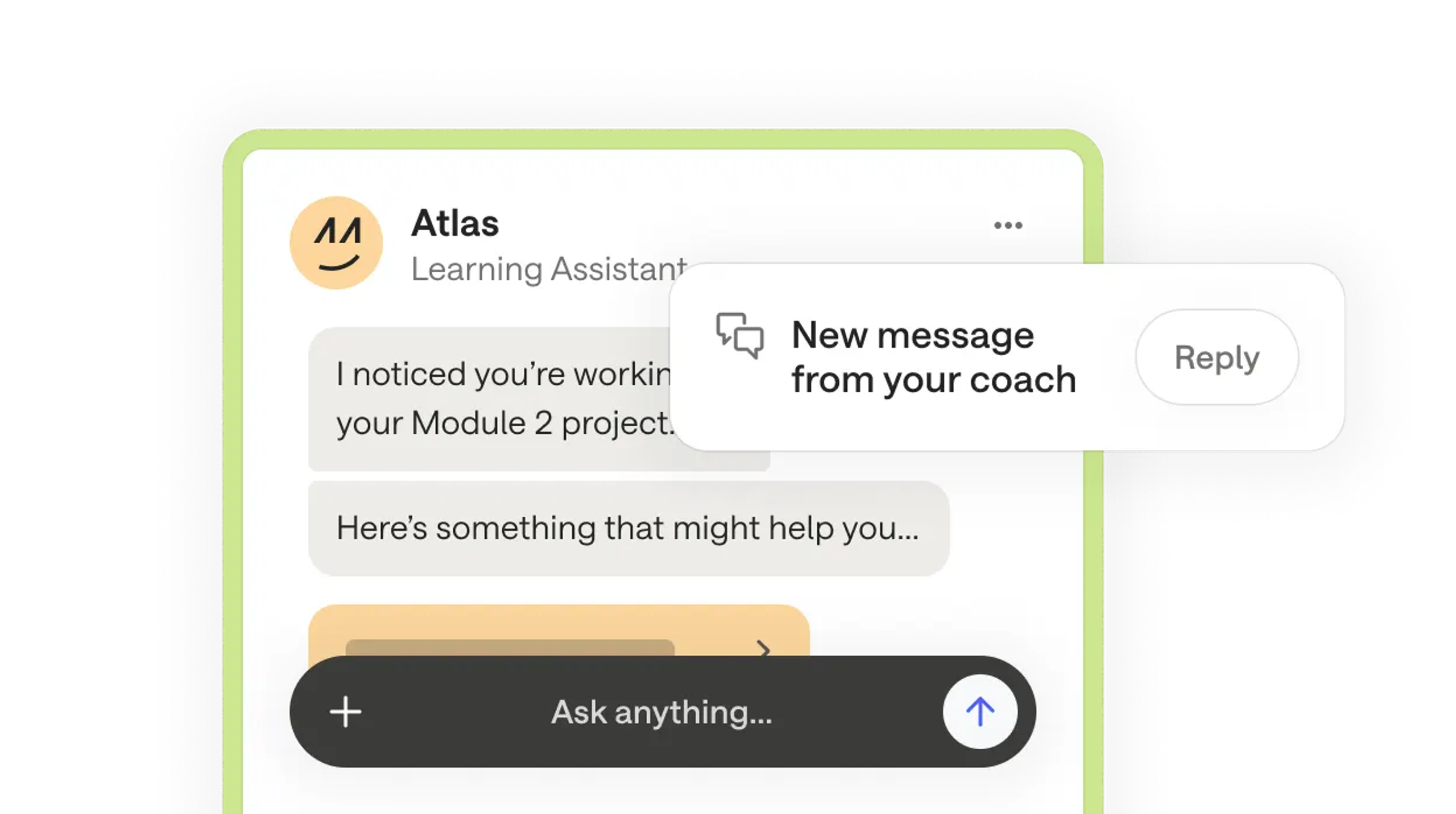

Expert-guided, AI-powered human coaching

An ecosystem of human and AI support means that learners are guided to success in their upskilling journey.

Transform careers

Everyone in your team has future-focused potential and deserves equitable access to economic opportunity.

Let’s get you to the right place

Popular programmes

Power upskilling and tool adoption at every level of your organisation.

Explore all programmes

Discover our full range to find the right fit for your goals.

How John Lewis Partnership stays one step ahead with data.

Discover how an iconic retailer transformed data capability and gave employees new confidence.

John Lewis Partnership03:21

Highlights

- Enabling efficiency with data

- Staying ahead of skills gaps

- Unlocking ROI from skills